Employer Portal Tips

Make payments on your schedule.

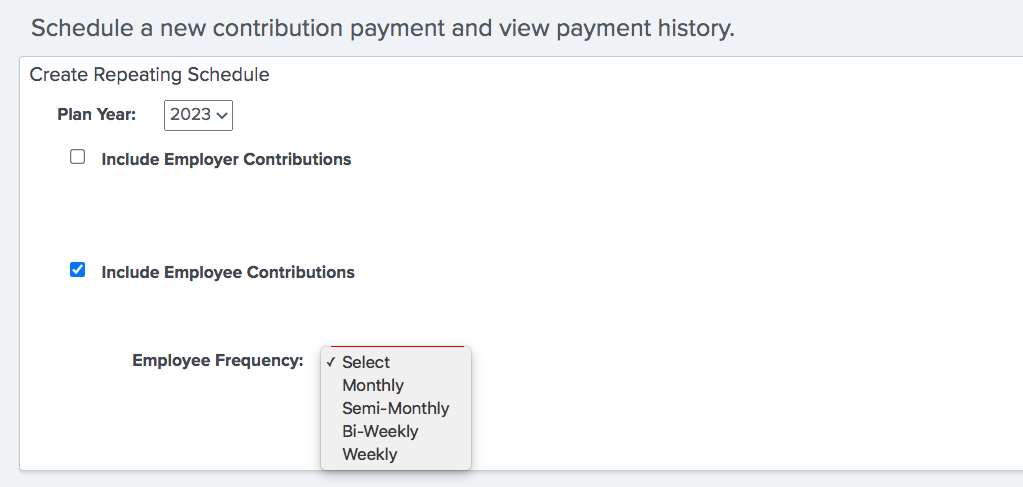

You can set up employer and employee contribution payments to fit your payroll schedule.

Employers can:

- Choose their scheduling frequency. Schedule recurring payments on a bi-weekly (i.e., every other week) or weekly basis, in addition to semi-monthly (i.e., twice per month), monthly, quarterly, and annual options.

Note: To satisfy Department of Labor regulations, employee contributions cannot be made on a quarterly or annual basis.

- Choose any semi-monthly payment dates. Select any two dates to withdraw payments for a semi-monthly schedule. We recommend that you use the same dates that you use for your semi-monthly payroll. One date must be during the first half of the month and the other date must be during the second half of the month. Each month’s payments will run on the same dates you selected. If you want the second payment to run on the last day of the month, select “31” as the second recurring payment date.

- Select when you want to make bi-weekly or weekly payments. The start date should correspond with your next payroll date of the plan year if you run a bi-weekly or weekly payroll. Subsequent payments will automatically recur every 14 days for bi-weekly payments and every 7 days for weekly payments, through the end of the plan year.

Payment Frequencies

Employer and employee contributions can have different payment frequencies. For example, you can make bi-weekly employee contributions and monthly employer contributions. Employer contribution payments are typically made on a monthly or quarterly basis.1

| Frequency | Employee | Employer |

|---|---|---|

Weekly | X | X |

Bi-Weekly | X | X |

Semi-Monthly | X | X |

Monthly | X | X |

Quarterly | X | |

Annually | X |

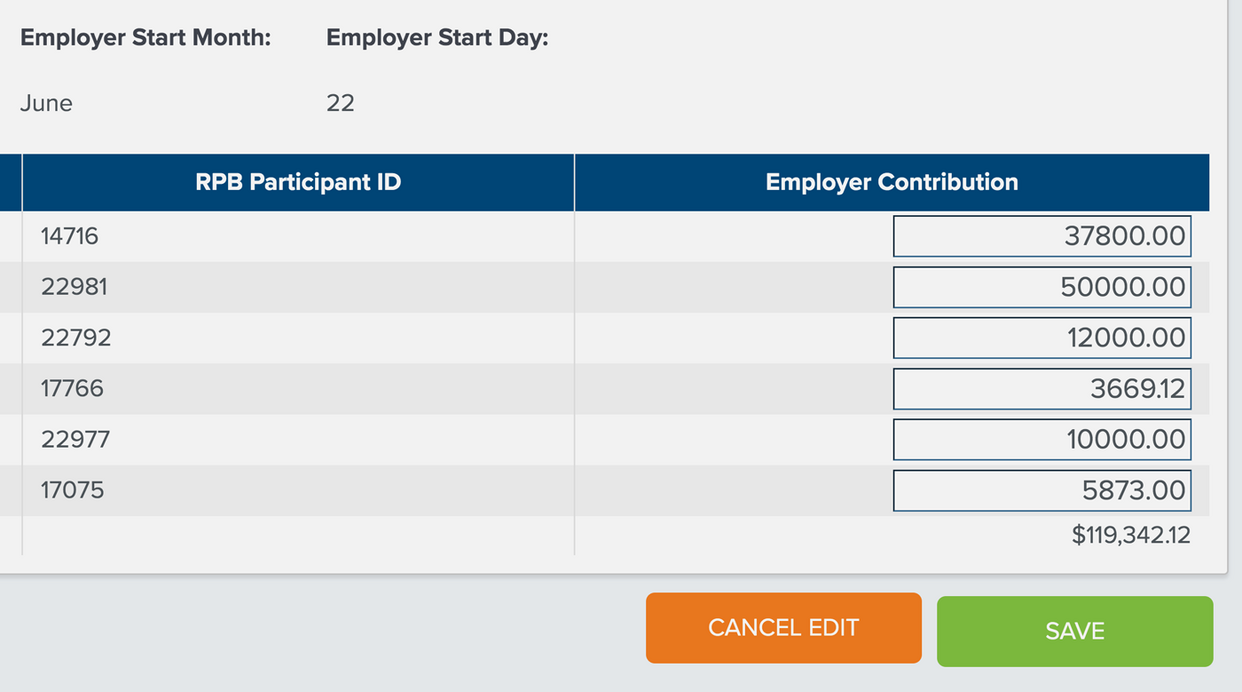

- Edit payments before you submit a schedule. You can now edit the payment details on the preview screen before submitting your payment schedule—whether you're creating a new schedule or replacing an existing one. The changes will flow through to all payments in a schedule without having to edit each individual payment.

This feature is helpful when you want the MyRPB payment amount to match your own calculations, or if compensation and/or contribution changes don’t align with the July-to-June plan year and RPB’s proration doesn’t match your own.

- When you edit RPB's payment amount to match your numbers, at the end of the plan year there may be a small positive or negative balance due shown on the View Retirement Plan Summary screen. Please contact RPB to make a balance adjustment in order to eliminate residual balances.

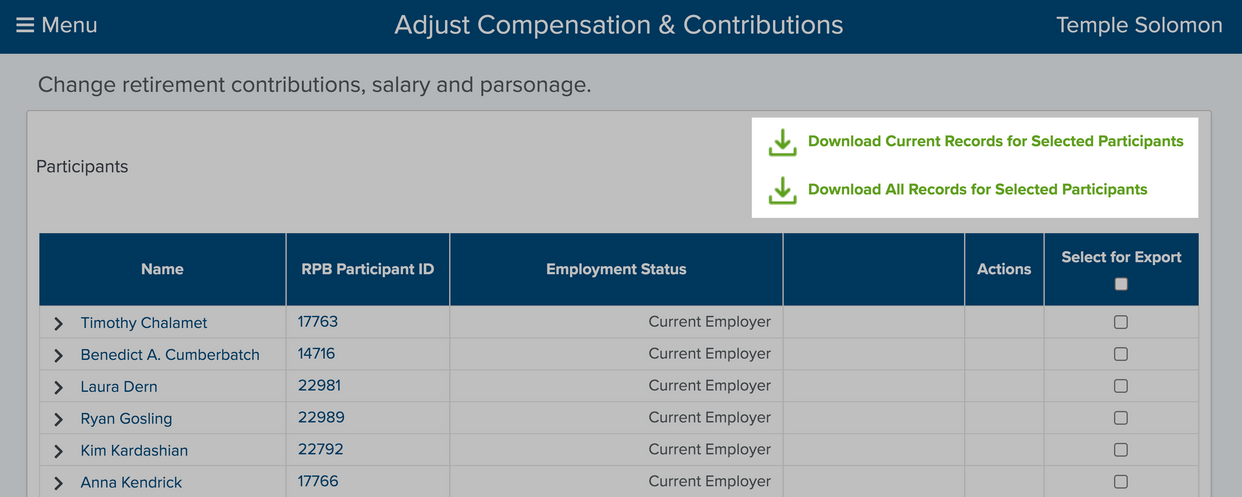

Generate reports and download data.

You can print a screen and/or download the data into Excel from the following portal screens:

View Retirement Plan Summary

Adjust Compensation and Contributions

Make Retirement Plan Payments

View LTD Plan Summary

Make LTD Payments

To print and export data on these screens, click the green links at the top right of the data tables.

Generate reports.

Employers can also generate and print two types of reports. The Generate Reports tile on the dashboard provides access to a Contribution Statement and Bank Activity report.

The Contribution Statement Report, available in a summary or detailed version, lists all employees and the contributions they received for the selected year. The detailed version shows how every payment for an employee was applied.

To generate the report:

Select “Summary” or “Detailed” report.

From the “View by Time Frame” dropdown, choose “Plan Year” or “Calendar Year.”

Select the desired year.

Click "Run and Print.”

The Bank Activity Report lists all payments made by your organization within a selected date range, regardless of product. This report is based on payment date, not plan year or calendar year.

To generate the report:

Select the desired date range.

Click "Run and Print.”