Jewish Values Investing

Decisions guided by our shared values

At RPB, we understand the importance of putting your investment dollars to work in building a better world. That’s why our investment decisions are informed, in part, by our Jewish Values Investing (JVI) Policy.

Our JVI Policy is rooted in the Jewish values of tikkun olam (repair of the world) and tzedek (justice), along with the fundamental beliefs articulated in the resolutions of the:

- Central Conference of American Rabbis (CCAR)

- Union for Reform Judaism (URJ)

- Commission on Social Action of Reform Judaism (CSA)

RPB’s JVI Policy represents our ongoing commitment to integrating Jewish values into our investment process while maintaining a primary focus on our fiduciary obligations as a retirement plan. It’s based on ethical environmental, social, and corporate governance (ESG) practices and support of Israel, along with other issue areas as appropriate.1

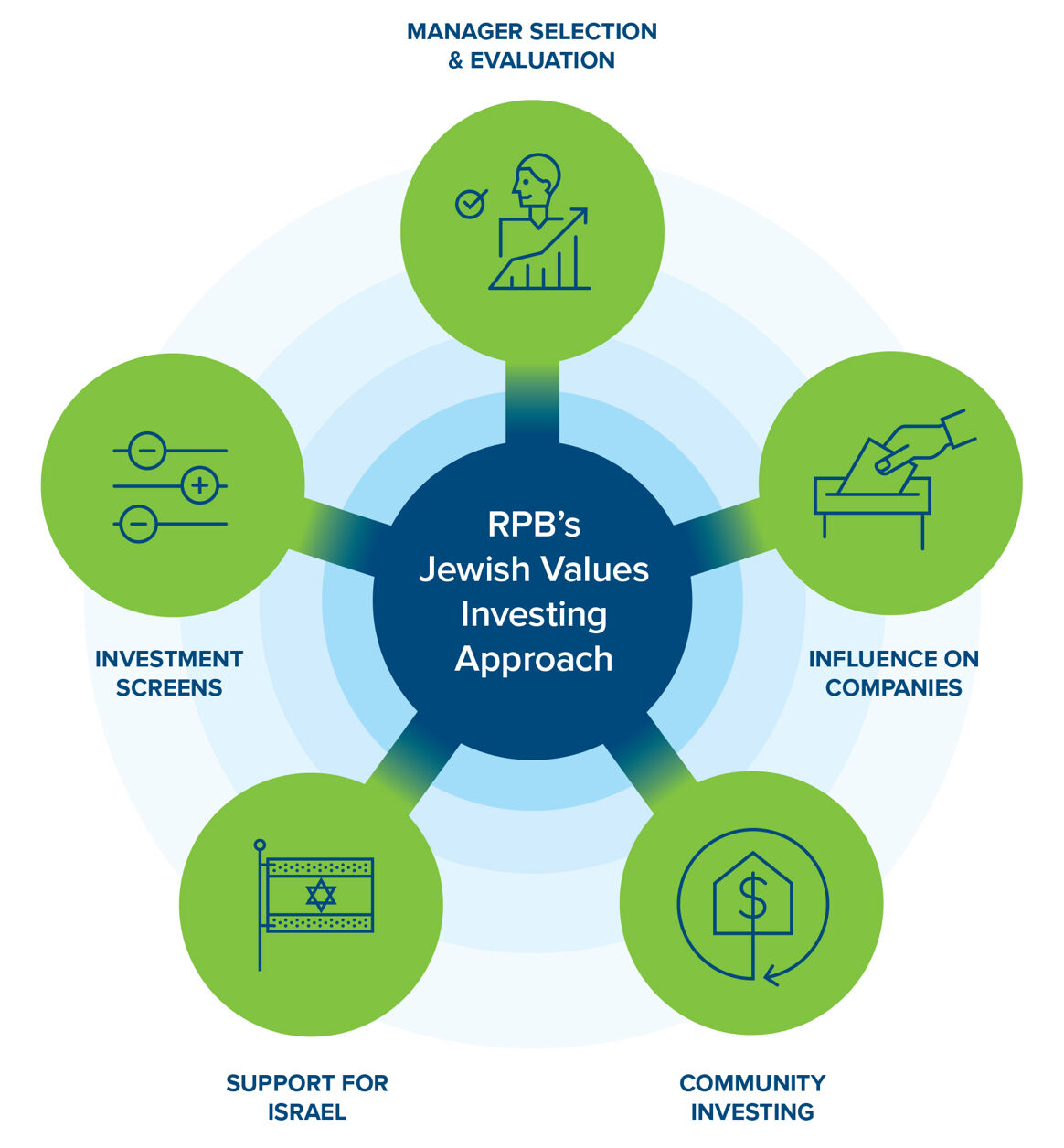

The five pillars of our policy

When selecting investment managers for our funds, RPB considers how they integrate ESG factors into their investment analysis and portfolio ownership practices.

We use both positive and negative screens to emphasize or overweight companies that align with our JVI criteria, and exclude or de-emphasize companies whose business practices do not.

Where RPB directly owns shares in a company, we use proxy voting and shareholder engagement to influence firms’ decision-making. RPB is also a member of the Interfaith Center on Corporate Responsibility (ICCR), which engages companies on ESG issues.

Support for Israel is a core value of the Jewish people and our Reform Movement. That’s why RPB strives to hold investments that positively impact Israel, its economy, and people.

RPB supports small businesses and affordable housing by investing in community bank CDs and 1.8% of our assets in community development agency bonds under URJ’s Chai Investment Program (CHIP).

Learn about your spectrum of choices.

RPB offers a range of investment choices with varying degrees of values alignment, including our Reform Jewish Values Stock Fund.

Why JVI?

Our JVI Policy is not just about doing what is right by our spiritual values. We believe that, alongside financial factors, ESG factors may positively affect the performance of investment portfolios, either by exposing potential investment risks or providing one indication of management excellence and leadership. And we’re not alone in this focus: in 2022, SRI strategies accounted for 12.6% ($8.4 trillion) of the $66.6 trillion in total US-domiciled assets under professional management.

We’re proud to include JVI as an important component of our process for selecting the most suitable investments for long-term financial performance. As a result, RPB's fund choices align with our Jewish values to varying degrees, with the Reform Jewish Values Stock Fund having the most alignment.

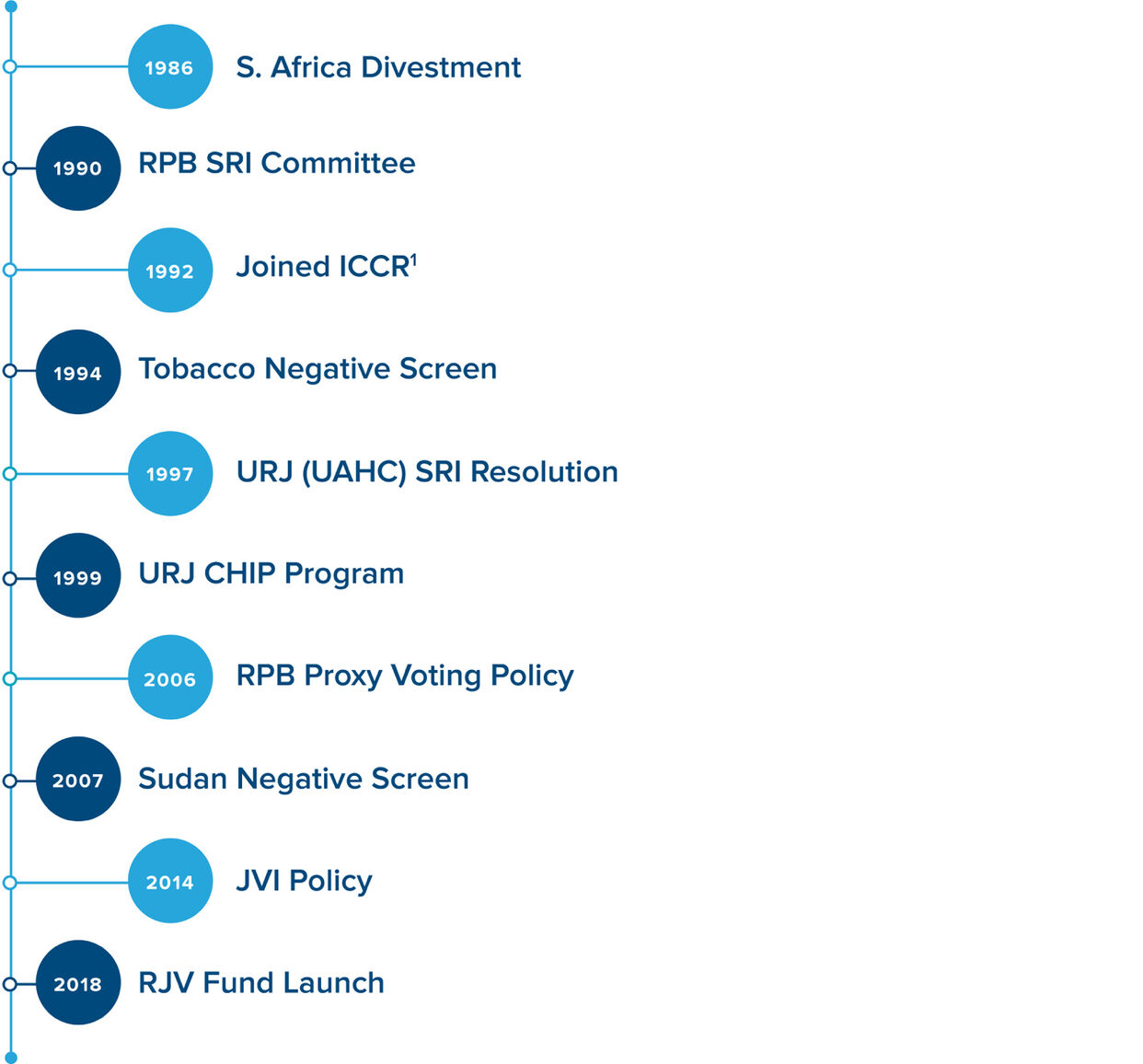

History of SRI at RPB

Over the years, we’ve achieved several milestones in implementing this policy, most notably the launch of our Reform Jewish Values Stock Fund (RJV). The first fund of its kind, the RJV Stock Fund has the highest degree of alignment with the environmental, social, and governance priorities of the Reform Movement of all of our funds.

- RPB is a member of the Interfaith Center on Corporate Responsibility (ICCR), which engages companies on ESG issues.

Ready to start investing?

The first step is understanding the options you'll have with your 403(b) account.