Employer Portal Tips

View your organization’s payment history by plan year (July 1 – June 30) or calendar year (January 1 – December 31) on both the View Retirement Summary and Make Retirement Payments screens.

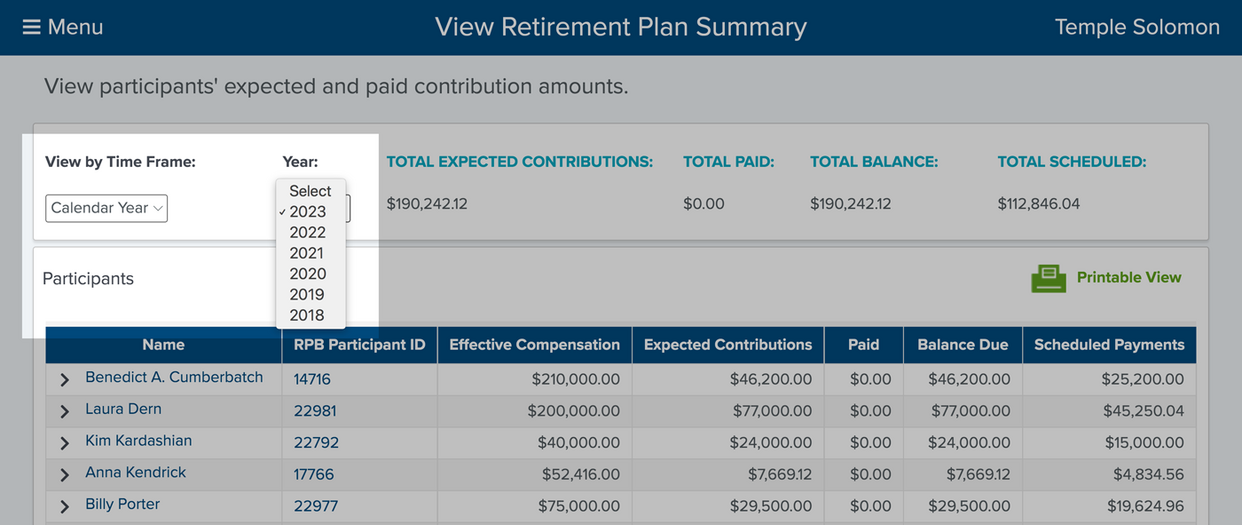

On the View Retirement Plan Summary screen, you can view compensation, contributions, amounts paid and balances due by calendar year or plan year.

On the Make Retirement Plan Payments screen, you can switch to a calendar year view to see all payments with the same payroll calendar year. This may help you (1) reconcile payments to payroll or (2) view payments that were made in the same calendar year but applied to different plan years.

In the calendar year view, employee pre-tax and Roth contributions should equal your payroll contributions for that year, regardless of your organization’s fiscal year,

Note: Payment schedules can only be created on a plan year basis.