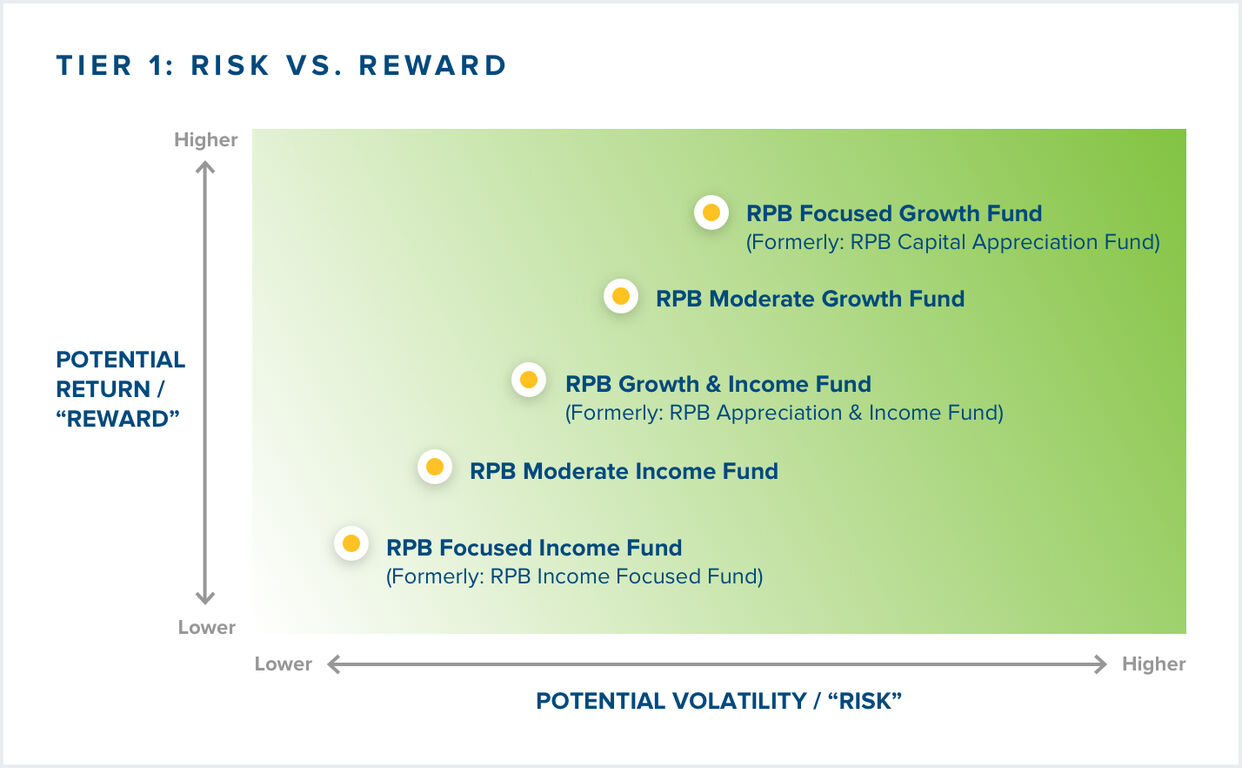

Tier 1: Target Allocation Funds

Instant investment diversification

Our Tier 1 funds are built for RPB participants who want a simple way to invest. Each of the five funds provides a complete, diversified portfolio in a single fund. That is why you will likely need only one of the Tier 1 funds to achieve the asset allocation you want.

Each fund has its own investment objective—growth, growth and income, or income—to align with a participant’s retirement goals, time horizon, and risk tolerance. And each invests in a well-diversified, fixed percentage of equities and fixed income so that you can step down your risk as you move closer to and through retirement.

RPB’s investment advisory firm, NEPC, which is guided by RPB’s Investment Committee and our Jewish Values Investing Policy, recommends the asset allocation and managers for our target allocation funds.

Selecting a fund from the new Tier 1 lineup

To invest in Tier 1, simply select the one fund that aligns most closely to your current investment objective, time horizon, and tolerance for risk, and you’re done! You’ll have a diversified portfolio for your RPB retirement plan.

Fund descriptions

RPB Focused Growth Fund

(Formerly: RPB Capital Appreciation Fund)

Target allocation: 95% equities, 5% fixed income

This is the most aggressive of the Tier 1 funds. Its high-growth and high-volatility strategy is designed to produce principal growth over a longer time period. The fund invests in a broad assortment of assets that have historically generated returns greater than income-oriented investments but also have greater volatility than income-oriented investments. Read the fact sheet

RPB Moderate Growth Fund

Target allocation: 75% equities, 25% fixed income

This is the second-most aggressive of our target allocation funds. Its moderate-volatility strategy is designed to achieve meaningful increases in account value with a lower level of volatility than the plan’s most aggressive fund. Read the fact sheet

RPB Growth & Income Fund

(Formerly: RPB Appreciation & Income Fund)

Target allocation: 55% equities, 45% fixed income

The RPB Growth & Income Fund seeks both principal growth and income. Its moderate growth and volatility strategy is designed to achieve meaningful increases in account value with a lower level of volatility than the plan’s most aggressive funds. Read the fact sheet

RPB Moderate Income Fund

Target allocation: 35% equities, 65% fixed income

The RPB Moderate Income Fund is the second-most conservative of the Tier 1 funds. Its low- to moderate-volatility strategy is designed to generate income, keep pace with inflation and generate some growth through a modest exposure to equities. Although principal value may fluctuate, the frequency and severity of losses incurred by similar portfolios have historically been less than those of growth-oriented investments. Read the fact sheet

RPB Focused Income Fund

(Formerly: RPB Income Focused Fund)

Target allocation: 15% equities, 85% fixed income

The RPB Focused Income Fund is the most conservative of the Tier 1 funds. Its low-volatility strategy is designed to generate income and keep pace with inflation. Although principal value may fluctuate, the frequency and severity of losses incurred by similar portfolios have historically been less than those of growth-oriented investments. Read the fact sheet

Fund details and comparisons

| RPB Focused Growth Fund | RPB Moderate Growth Fund | RPB Growth & Income Fund | RPB Moderate Income Fund | RPB Focused Income Fund | |

|---|---|---|---|---|---|

Most appropriate for investors who | Care most about long-term growth and have an above average risk tolerance. | Care more about long term growth than current income and have an above average risk tolerance. | Care about growth and moderate income and have a moderate risk tolerance. | Care more about current income but want some long-term growth potential and have a conservative risk tolerance. | Care most about current income but desire a modest level of inflation protection and have a low risk tolerance. |

Time horizon | Long | Medium to Long | Medium | Short to Medium | Short |

Fund risk level |

|

|

|

|

|

Target investment allocation |

|

|

|

|

|

Fees1 | 0.45% | 0.41% | 0.37% | 0.31% | 0.26% |

- Participants also pay an RPB Administration Fee (0.18%) as well as a Custody, Recordkeeping, and Investment Consulting Fee (approximately 0.04%) which fluctuates slightly over time and is passed on to participants at cost.

Building a customized portfolio with multiple Tier 1 funds

If your circumstances call for an asset mix that's different from the Tier 1 pre-built mixes, this chart shows you how to properly use multiple Tier 1 funds to achieve your desired asset allocation. You can also combine the Tier 1 funds with the funds in Tier 2 or Tier 3. We suggest you consult with a financial professional.

Looking for more hands-on investing?

Our Tier 2 self-directed funds allow you and your financial advisor to build a custom portfolio across asset classes.