Knowledge Center

Cash: Trash or King?

By David Baskin, Chair, RPB Board of Trustees

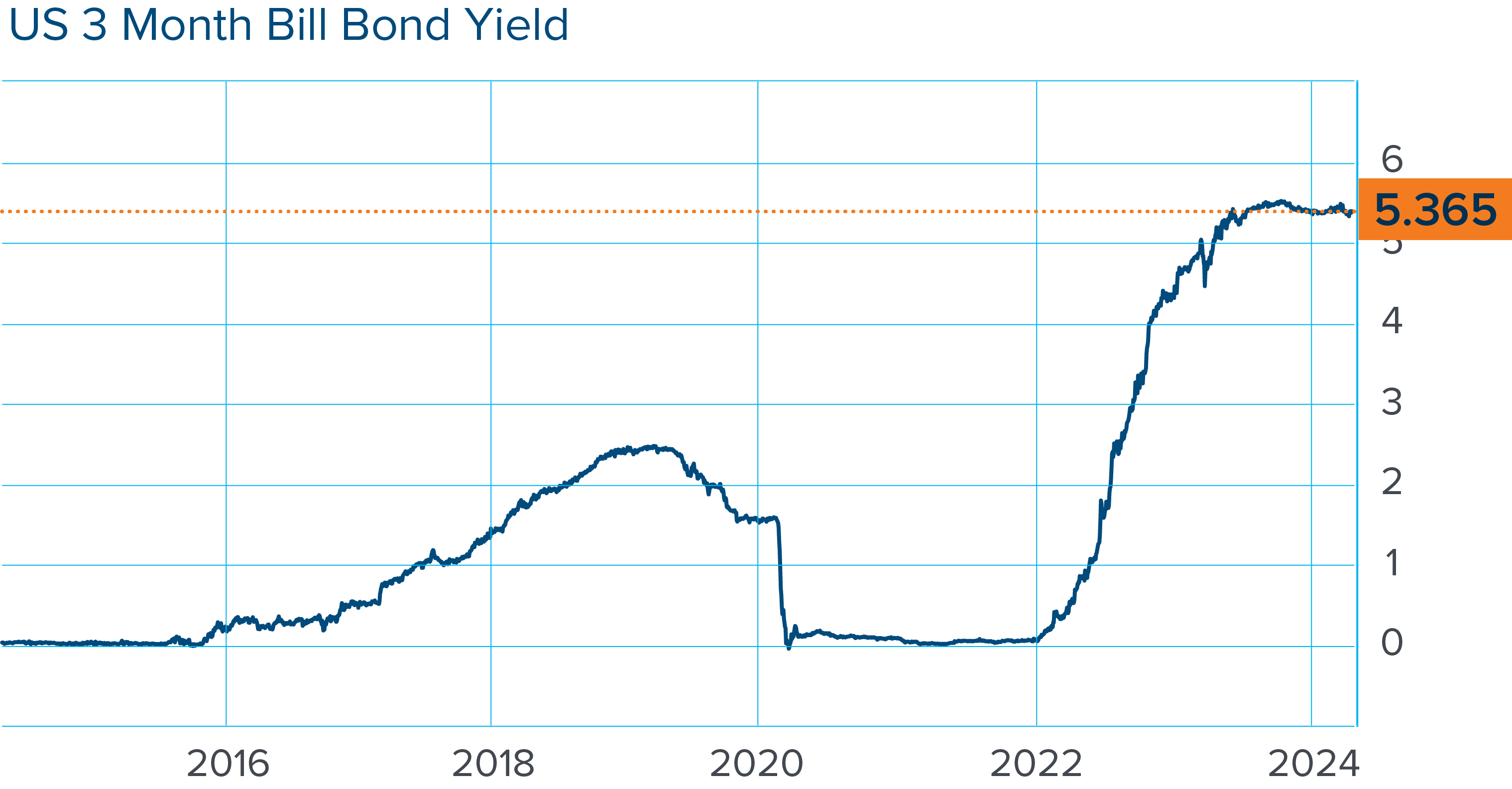

Today, investing in a 90-day U.S. government bond (which is equivalent to cash in the financial world) pays over 5% in interest per year. In contrast, for the previous 10 years, the best interest rate you could get on the same bond was less than 2.5%, and that only lasted for about a year. For four full years, the rate was barely above 0%.

During the recent ten years of very low interest rates, cash was “trash” |

|

The transition from trash to king

What happened? Early in 2022, inflation started to rise sharply. To fight this rise in inflation, the US Federal Reserve Board boosted interest rates by about 5% over a one-year period to try to slow down the economy.1

The Fed’s strategy has been working, but not as quickly as most economists and market forecasters thought it would. Despite rising interest rates, the U.S. economy has remained strong, with continued record low unemployment and higher than expected economic growth. Inflation has fallen from its peak but is stuck in the 3% to 3.3% range—above the 2% level where the Fed wants it to be. Now, economists expect rates to stay “higher for longer.”

So after years of rates hovering around zero, cash is paying attractive interest rates. And by “cash” we mean any short-term investment that can be turned into cash relatively quickly and easily and has less potential for loss due to market ups and downs. This includes short-term bonds, bank CDs, and money market funds.

King or trash, cash isn’t a smart long-term investment

As the stock market moves up and down—sometimes dramatically—investors can be tempted to “time” the market. They often do this by moving investments into cash when stocks drop and then getting back into the market when stocks go up.

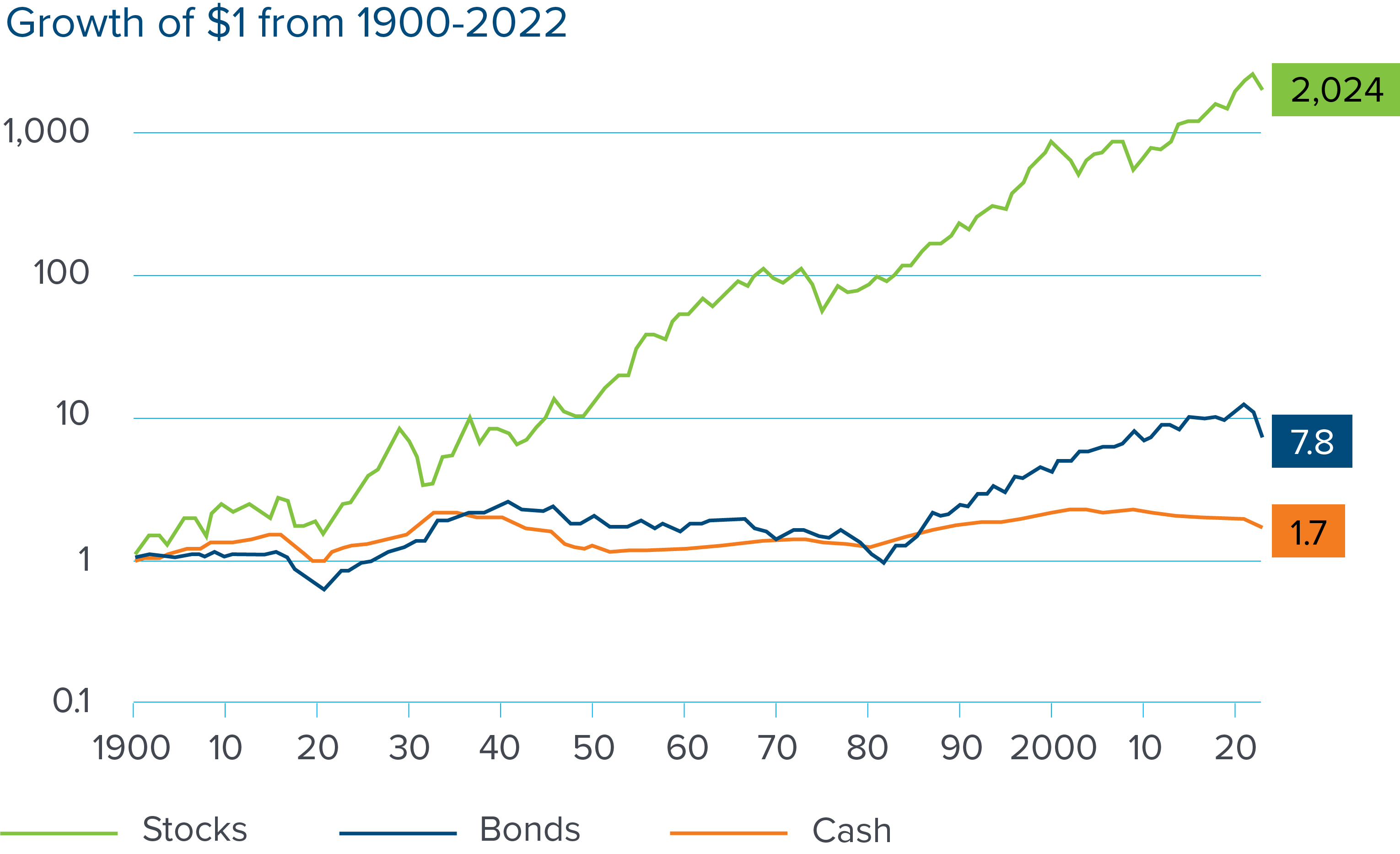

This is almost never a good idea. For example, in the years before the recent sharp rise in rates, trying to time the market by staying in cash or short-term bonds produced almost no income. It also came with a high opportunity cost: during seven of those ten years, stock markets had gains in the double digits. Holding a lot of cash was very much a losing strategy.

And while investors are getting great interest now on short-term investments, when the Fed eventually cuts rates as expected, the interest you’re earning on that cash will come down. Holding onto cash is not a winning strategy over the long term. Most financial advisors understand that investors need cash to meet significant planned or unplanned expenses—like tax payments, a down payment on a house, or an automobile repair—but few would view cash as a good long term investment. Over time, high-quality stocks have outperformed cash savings and short-term bonds by large margins, and most expect that will continue to be the case—even with today’s high interest rates.

Cash: Low risk in the short term, high risk in the long term |

|

|

The role of cash in your savings plan

In retirement planning, the role of cash is different across different life stages based on your financial needs and objectives at different points in your life.

If you’re a younger investor, holding too much cash can significantly impact the likelihood of reaching your long-term financial goals. A three-to-six month cash emergency fund is a good idea. It can give you flexibility and safeguard against surprise expenses. But once you have that cushion, contributing as much as you can as early as you can to your retirement account will typically lead to greater wealth building over time due to the power of compounding.

When you’re retired and withdrawing money from your retirement account, you may want to use the “bucket” strategy to make sure you have enough cash to pay living expenses and also stay invested for growth. The bucket strategy involves dividing your money into three different buckets based on when you’ll need it:

Short-Term Bucket: This is for immediate needs, like living expenses and emergencies. It's made up of safer cash and cash equivalents like short-term bonds and stable value funds.

Intermediate-Term Bucket: This covers expenses for the next few years. It includes moderate-risk investments like bonds or balanced mutual funds.

Long-Term Bucket: This is for expenses further down the road, like healthcare or leaving money to family. It's invested in things that can grow more over time, like stocks.

RPB’s retirement plan has three funds in Tier 2 that may be appropriate for this short-term bucket:

Generate income | |

Vanguard Short-Term Inflation-Protected Securities Index Fund | Generate income and guard against inflation |

Stability of principal |

Please note that all investments carry some level of risk, including the potential loss of principal, and past performance is not indicative of future results. There is no guarantee that any investment strategy will achieve its objectives or generate profits. Before making any investment decisions, we recommend that you consult with a qualified financial advisor.

- The US Federal Reserve Board, often referred to as “the Fed,” sets national interest rate policy—the underlying interest rate for borrowing money that almost all other interest rates are based on. Generally, raising interest rates slows economic activity (and, in the case, price inflation) by making it more expensive for businesses to borrow money. Lowering rates generally does the opposite.